Setting up a budget

First look at the current situation

As it

probably is for many of you, it’s been financially very tight. I can’t really

describe it differently than the law of Murphy (Everything that can go will

wrong, will go wrong).

A few events

probably leaded up to this, it really felt like a domino effect.

A couple of

years ago we bought a cozy appartment, with some work. It was the only thing we

could afford at the time.

We took a

loan for the building and one to cover the renovations, that part was planned

and calculated.

Lots of

things went wrong, our upstairs neighbors had a big leak, which was right above

our bedroom and everything was starting to get mouldy. Lots of builders messed

up. We had to redo like 70% of the work, because it wasn’t finished safely or

it went wrong somewhere. It went to a point where we needed to take another

loan for those extra renovations.

I got

pregnant, which was like miracle for us, as we struggled so much on this road.

But so the pressure to get everything done was getting higher.

The last

builder did a good job, but he kind of hustled us with the end invoice where we

needed to pay a lot more. It’s a long story and to keep it short, we couldn’t

get out of that.

So besides

the loaned money, we also had to use the little bit of money we saved up for

the baby, to pay at this last builder. We were literally broke.

It really

felt like the old movie from the 80’s The Money Pit with Tom Hanks.

A lot of

times we felt like we were going to go crazy.😵

The renovation work still is done, but it’s safe enough for the baby.

Then the

bad news piled up. At work they didn’t want to extend my contract because I was

pregnant. So I had to quit just a couple months before the birth. Which made

that the disability money for mothers was really low as I was unemployed.

That wasn’t

the last of it. My hubby got fired because the company reorganized and lots of

people were laid of. So it’s been

though, probably doesn’t cover it.

We were

extremely blessed with our family as they helped us out to get the most

important baby items.

Luckily my

hubby has found a new job. So it’s going to get a bit better the next couple of

months. We’ve been really busy with finding solutions, the renovations and now

dealing with our emotions with our new little miracle.

Even with

all the financial trouble, I feel really blessed with my son, as we’ve been

waiting so long to hold him in our arms. But definitely now for him, I must

work hard to keep it all under control.

I’m going

to need to be frugal and cut some costs.

Cutting

costs

The first

thing I did was look for other providers(internet, electricity, insurances,…)

that were cheaper, but still provided us the things we needed. Taking the time

for this, saved us around of €150/$177 per month. But be warned: this can be stressful,

you need to call and mail a lot and it takes some time. It’s worth it in the

end though.

Some

expenses we’ve completely cut. Like clothing, we literally can’t afford this

until December. Which is probably embarrassing to admit, but not a lot we can

do about that now. Seems like I need to get crafty with needle and thread.

The biggest

expense are the loans, but most of them can’t be fixed for a while. Now with Corona pandemic, it was luckily an option to call the bank and get a delay of six

months for the mortgage. Which was a back-up the government provided for the

ones who were fired around the pandemic. So a little breathing space there for

a while.

I can’t cut

costs for the baby necessities like his food, as he needs special milk for his

reflux.

A big expense

is our food. So I looked for options to lower it. I went to shop in local shops

and markets instead of the bigger supermarkets. I make a list before and

definitely don’t go shopping when you’re hungry.

It’s been

basicly back to basics. So lots of grains (like quinoa, couscous,…), eggs,

flours, fresh veggies, potatoes. My back hurts a bit, since we can’t get it

delivered anymore as that costs money for now. No car. But basicly I had to set

a strict budget for €180/$212,4 a month for the next couple of months. This is

ofcourse without the baby food, it’s just for us two. It’s very tight, but it’s

doable. I keep snacks and special drinks for my hubby as he has a bigger need

for it. I need to lose some weight from my last pregnancy anyways, so it can’t

hurt.

We must be

strict, as for the moment we don’t have any savings. So if anything goes wrong

now, it’s bad. Which means we really have to build up savings in the next

couple of months.

Setting

up a schedule.

Now it’s

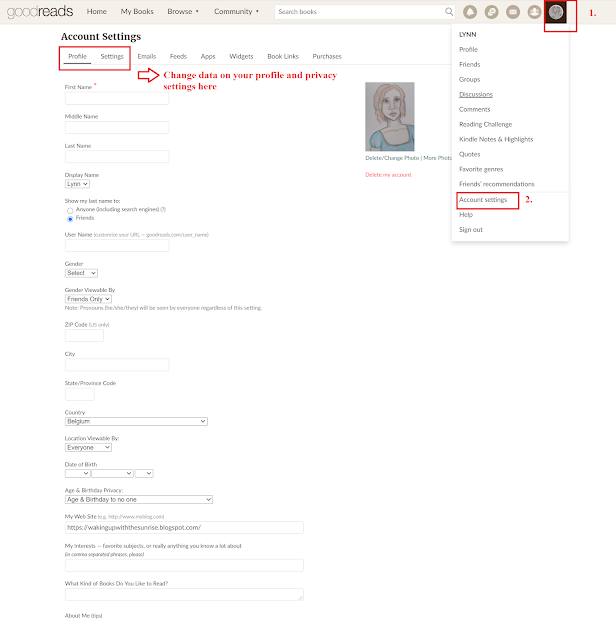

excel time. You can also download OpenOffice here, and use the Calculator program. It’s

completely free.

I collected

all the bills and used my bank app.

I placed

everything in an Excel-file, expenses and income divided. I tried to use colors,

so it’s easier to read.

So an basic example could be

Comments

Post a Comment